Content

- An Income Statement Transaction Example

- Tools

- Reimburse Visitor’s Travel Expenses

- 6.1 Miscellaneous Credit to a General Ledger Account

- With Ignore Trailing Zeros disabled for header account

- Creating your Chart of Accounts

- Definition of General Ledger Account

- Unallowed Costs

- Setting up required GL accounts and where to find them.

A default Accounts Payable (A/P) account should be configured if there are multiple A/P accounts in your G/L. This setting is located in the Purchasing Options section of Configuration Management. You can create multiple Branches, Warehouses, or Product Classes (or other Sales/COGS options) in order to assign each sub category to a grouping in Acctivate.

- In conclusion, a GL Account is an important financial tool used by businesses to track and monitor their finances.

- A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance.

- This provides quick transition and gives full access to all bank account information via both the Bank Account and the GL Account.

- The amount displayed on the Balances tab reports through to the Balance Sheet and is the total of all Year End Adjustments for the financial year.

- A general ledger summarizes all the transactions entered through the double-entry bookkeeping method.

- After the parts are defined, instances of the accounts are set up.

You can quickly select which topic you are interested in by selecting it from the list, or you can scroll down the page to view the entire table of contents. Learn about ways other industries are using blockchain technology. Companies use a general ledger reconciliation process to find and correct such errors in the accounting records. In some areas of accounting and finance, blockchain technology is used in the reconciliation process to make it faster and cheaper.

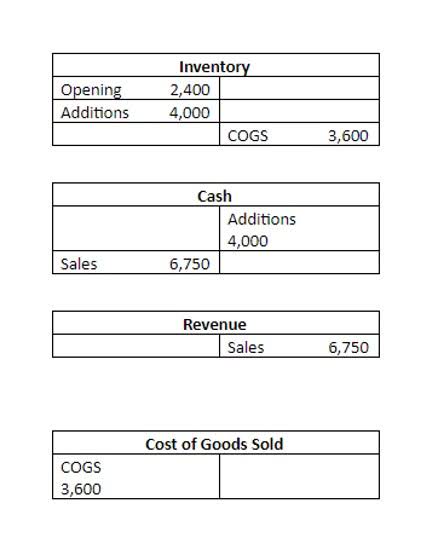

An Income Statement Transaction Example

Select the GL account number to which the funds are to be transferred;

from the adjacent option list. Select the GL account number from which the funds are to be transferred;

from the adjacent option list. In this block, you can capture details of the currency denominations

involved in the transaction. If you modify the transaction amount, then click ‘Recalc’

button to re-compute the amount to be credited to the GL account.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

Tools

On saving, the system validates and ensures for minimum mandatory

data entry. If the data entry is found alright, it will calculate the

charge based on the transaction type. Once you click ‘Pickup’ button once, then on amendment

of xrate, amount, charge, pickup will be mandatory before save. On pick

up, the fields that are currently enabled in the enrich stage will alone

be retained as enabled fields.

- The approver can fetch this

transaction for his/her task list and authorize it. - These tools integrate core accounting functions with modules for managing related business processes.

- In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200.

- Their net balances, positive or negative, are added to the equity portion of the balance sheet.

- You can select the appropriate code from the adjoining option list that

displays all the currency codes maintained in the system.

As always, changes to these lists from the last version are highlighted. Refer the section

titled ‘Specifying UDF details’ under ‘Miscellaneous

Debits to a Customer’s Account’ for further details. The system computes the denomination value by multiplying the denomination

value with the number of units.

Reimburse Visitor’s Travel Expenses

For more information on this method, see our article on importing your data from excel. The Chart of Accounts (CoA) is the basis of your organization’s gl account accounting. Here you will have all the accounts you need to keep track of the transactions taking place in your organization.

These are also accessible from …More Options within a bank account. Within a bank account, information and transaction history is available via multiple tabs and Enquiry. In case of multiple accounts with the same account

number, the system will display a list of account numbers with account

branches to select.

6.1 Miscellaneous Credit to a General Ledger Account

In the case of certain types of accounting errors, it becomes necessary to go back to the general ledger and dig into the detail of each recorded transaction to locate the issue. At times this can involve reviewing dozens of journal entries, but it is imperative to maintain reliably error-free and credible company financial statements. This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis. You can release advances by account credit through the ‘Advance

By Transfer’ screen. Similarly, you can perform miscellaneous credit to a customer account

with the corresponding debit to a GL account.

We’ll also provide some examples and tips to help you get started with your own GL Account. The system displays the total amount credit to the GL account inclusive

of the service charges in the transaction currency. The physical

account number is identified based on the Virtual Account Number and

Account Currency combination. If there is no physical account available

for the combination, then a default physical account number is selected. The account currency changes as per the default physical account number.

With Ignore Trailing Zeros disabled for header account

The summary amounts are found in the Accounts Receivable control account and the details for each customer’s credit activity will be contained in the Accounts Receivable subsidiary ledger. Here is an example of an accounting system transaction within a general ledger for a fictional account, ABCDEFGH Software. Note that this example refers to ABCDEFGH Software’s cash account.

What is the GL account in SAP?

General Ledger (G/L) accounts are used to provide a picture of external accounting and accounts and to record all the business transactions in a SAP system. This software system is fully integrated with all the other operational areas of a company and ensures that the accounting data is always complete and accurate.

The difference between these inflows and outflows is the company’s net income for the reporting period. Some general ledger accounts can become summary records and will be referred to as control accounts. In that situation all of the detail that supports the summary amounts in one of the control accounts will be available in a subsidiary ledger. However, the trial balance does not serve as proof that the other records are free of errors. For example, if journal entries for a debit and its corresponding credit were never recorded, the totals in the trial balance would still match and not suggest an error. A company may opt to store its general ledger using blockchain technology, which can prevent fraudulent accounting transactions and preserve the ledger’s data integrity.

Comentarios recientes